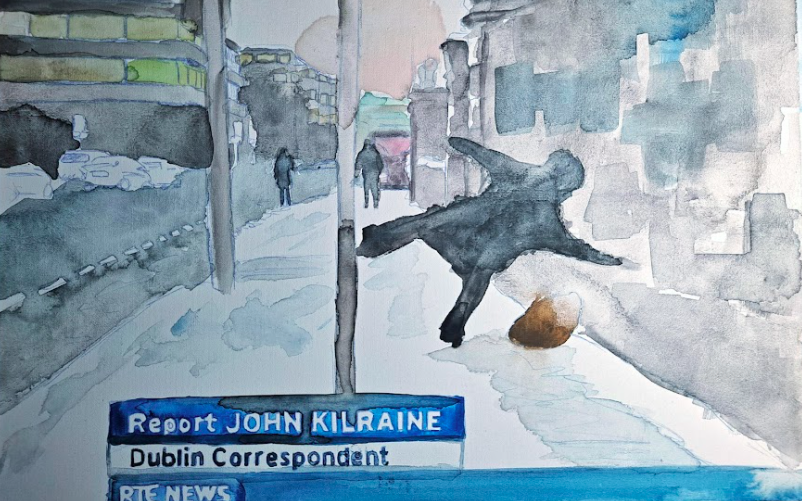

Were you one of the many, many people who left this beautiful country when the recession hit in order to find work?

Did you think there was no choice but to head down-under in order to make some money? Well you could be missing out on a big tax refund that you left behind.

With almost 40,000 Irish workers having travelled to New Zealand since the Recession, many have returned in recent years as the Irish economy improves and work becomes more readily available.

But leading tax refund specialists Taxback.com say that, at a guess, 50% if not more of returnees could have left money behind in the form of tax refunds.

In light of this,the website have launched their “Bullsh*t-Free Guide to New Zealand Working Holiday Taxes.

Eileen Devereux, Commercial Director of Taxback.com said about the refund:

“The most recent stats show that between June 2009, which was approximately a year after the Recession hit the country, and January 2017, 4,008 Irish workers were approved for residency visas in NZ and 33,226 Irish Workers were granted work visas.

“Thankfully, the economy has improved since then and the nation is now calling out for our Irish workforce to return home – particularly in the construction industry.

“So, of the thousands returning from New Zealand in the last few years, as a leading tax refund provider in the country, our experience would suggest that more than half of returnees are not completing the necessary tax filing requirements – and could be missing out on significant tax refunds as a result.”

The online resource provides New Zealand working holidaymakers with an easy-to-access, easy-to-use tax guide that will enable them to understand how the New Zealand tax system works, what reliefs are available to them and how they can go about claiming their tax refund.

“To put it simply – people find tax confusing. And understandably so. When people come home their focus tends to be on setting up the financial affairs here rather than tying them up in New Zealand. But our message is that people should do both

“Millions of dollars in tax refunds go unclaimed by working holidaymakers every year and it’s down to many misconceptions and a lack of awareness around tax. But when you consider the fact that the average New Zealand tax refund with Taxback.com is $550, it’s easy to see that is worth claiming what you’re owed.”

Topics covered in the Guide are as follows:

- New Zealand Tax for working holidaymakers – the Basics

- Residency Status

- Tax Rates

- Double Tax Agreements

- Important tax forms and documents

- Lodging a tax return

- Claiming your tax refund

- And more

You can find more information on the refund here.

READ NEXT: Nearly 100,000 Married Irish People Are Missing Out On Big Marriage Tax Savings

Topics:

RELATED ARTICLES

MORE FROM Lovin

MORE FROM Lovin